Explore the Deluxe of Lincoln Continental at Varsity Lincoln Dealerships

Wiki Article

Extensive Evaluation of Vehicle Leasing Options: Finding the Ideal Fit

When taking into consideration a cars and truck lease, factors such as lease terms, end-of-lease options, and the comparison between leasing and purchasing all play an essential role in making an educated decision. By discovering the details of various leasing contracts and understanding just how to negotiate desirable lease deals, one can lead the method towards a financially audio and rewarding leasing experience.

Kinds of Automobile Leasing Agreements

When considering automobile leasing choices, people can pick from different kinds of renting contracts customized to their certain requirements and choices. Both main types of auto leasing agreements are open-end leases and closed-end leases. Closed-end leases, also referred to as "walk-away leases," are one of the most common type of customer lease. In this contract, the lessee returns the vehicle at the end of the lease term and is not liable for any kind of extra prices past excess mileage and wear and tear. Open-end leases, on the other hand, are a lot more frequently used for commercial leasing. In an open-end lease, the lessee is accountable for any type of distinction between the residual worth of the lorry and its real market value at the end of the lease term. Furthermore, there are also specialized leases such as sub-leases and lease presumptions, which permit unique plans between the owner and lessee. Understanding the various kinds of leasing contracts is vital for individuals wanting to rent a car that aligns with their economic goals and usage requirements.Variables Influencing Lease Terms

Understanding the crucial factors that affect lease terms is essential for people looking for to make informed choices when becoming part of a car leasing contract. One essential aspect is the car's depreciation. The price at which a car sheds value in time dramatically affects lease terms. Cars with reduced devaluation rates typically lead to extra beneficial lease terms. An additional critical element is the lease term size. Shorter lease terms usually feature reduced rates of interest however higher monthly payments. On the various other hand, longer lease terms could have reduced regular monthly settlements yet can wind up setting you back extra due to accruing interest with time. The lessee's credit rating additionally plays a substantial duty in identifying lease terms. A higher credit report can bring about lower interest prices and much better lease conditions. Additionally, the negotiated market price of the vehicle, the cash aspect established by the leasing company, and any deposit or trade-in worth can all influence the final lease terms used to the individual - lincoln dealers.

Understanding Lease-End Options

As home the lease term approaches its verdict, lessees need to very carefully analyze their lease-end alternatives to make enlightened decisions. One important consideration is understanding the various choices readily available, such as returning the lorry, acquiring it outright, or exploring lease extensions. Furthermore, thinking about future needs and choices can help in determining whether to rent a brand-new lorry, prolong the current lease, or decide for a different automobile purchase technique.Comparing Leasing Vs. Acquiring

Tips for Bargaining Lease Deals

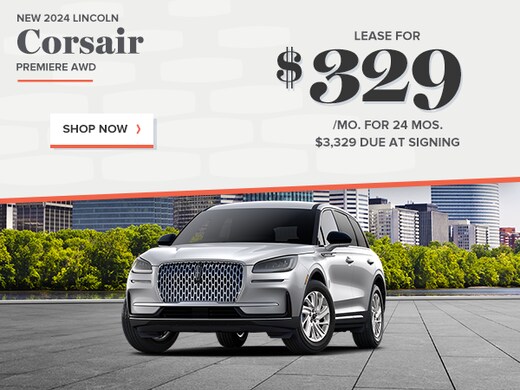

When discussing lease offers for a cars and truck, it is necessary to completely research and recognize the problems and terms used by different dealerships. Beginning by figuring out the kind of automobile you need and exactly how lots of miles you usually drive in a year. This info will certainly aid you negotiate a lease with the proper gas mileage allocation to avoid excess gas mileage costs at the end of the lease term.One more tip is to ask about any readily available lease rewards, such as rebates or unique promotions, that can aid reduce your monthly payments. In addition, consider bargaining the capitalized expense, which is the initial cost of the vehicle prior to taxes and fees. Purpose to reduce this price via arrangement or by trying to find vehicles with high recurring values, as this can lead to more appealing lease terms.

Furthermore, thoroughly review the lease contract for any kind of concealed fees or fees, and do not be reluctant to ask inquiries or seek information on any unclear terms. By being ready and educated to discuss, you can protect a desirable lease deal that satisfies your demands and budget.

Conclusion

To conclude, cars and truck leasing supplies different options that can be tailored to individual demands and choices. Recognizing the types of renting arrangements, variables influencing lease terms, and click this link lease-end options is essential in making an informed decision. Comparing getting versus renting can assist establish one of the most economical choice. By discussing lease offers properly, people can safeguard a desirable contract that suits their needs. Think about all factors meticulously to discover the perfect fit for your cars and truck renting demands.

When considering an automobile lease, elements such as lease terms, end-of-lease alternatives, and the comparison between leasing view publisher site and acquiring all play a critical duty in making a notified decision. Closed-end leases, likewise understood as "walk-away leases," are the most usual type of customer lease. In an open-end lease, the lessee is accountable for any kind of difference in between the residual worth of the car and its actual market worth at the end of the lease term. Additionally, the bargained selling rate of the automobile, the money variable set by the leasing firm, and any type of down settlement or trade-in value can all influence the last lease terms provided to the person.

Understanding the kinds of renting contracts, aspects affecting lease terms, and lease-end alternatives is essential in making an educated decision.

Report this wiki page